Electronic waybill, popularly known as an e-Way bill is a document that needs to be generated for consignment involving the movement of goods beyond the notified value. Most states have a threshold value of 50,000 and a higher threshold value in a few states.

e-Way bill is not a new concept. It has been in place for a few years now and in fact, even before GST with different names. We all know it is a process that requires the supplier/transporter to generate an e-way bill from the portal before transporting or shipping the goods. Once the e-way bill is generated, a unique number is generated for a specific consignment along with an e-way bill document and the supplier can choose to capture it on the invoice.

Today, most businesses generate e-way bills by mentioning the invoice details on the portal either using offline tools (JSON) or direct entry on the portal. While it is a mandatory need, but the effort and time that goes into generating the e-way bills, make the entire process of invoicing to shipping a cumbersome one. Guess, this is a common difficulty that you must have already felt irrespective of how big or small is your business.

To alleviate the difficulty in the current way of generating the e-way bill and to make the entire process simple and seamless, the latest release of TallyPrime comes with an inbuilt connected e-way bill solution that generates e-way bill instantly.

Yes, you read it right! You just need to record an invoice and the e-way bill be generated automatically.

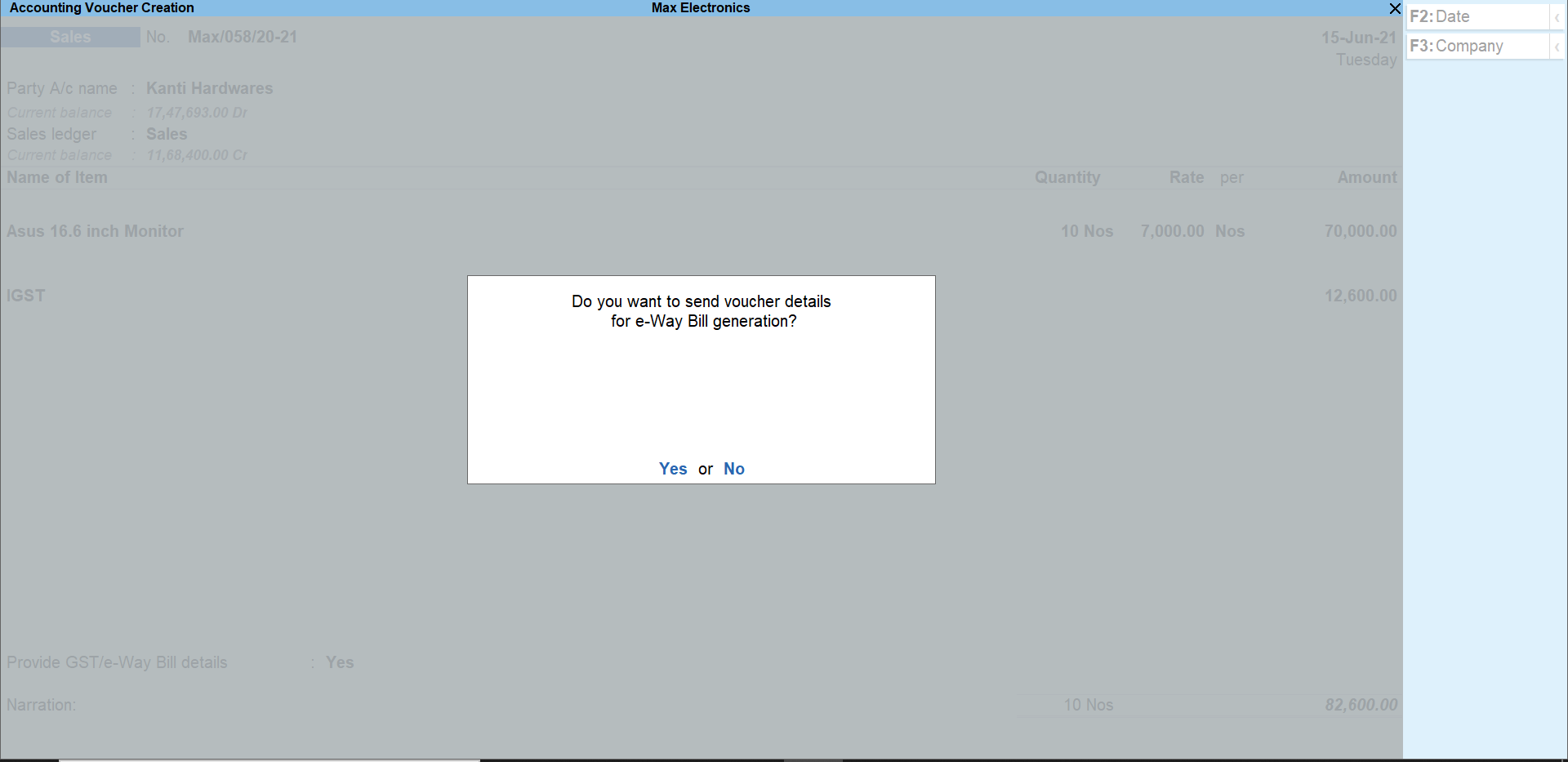

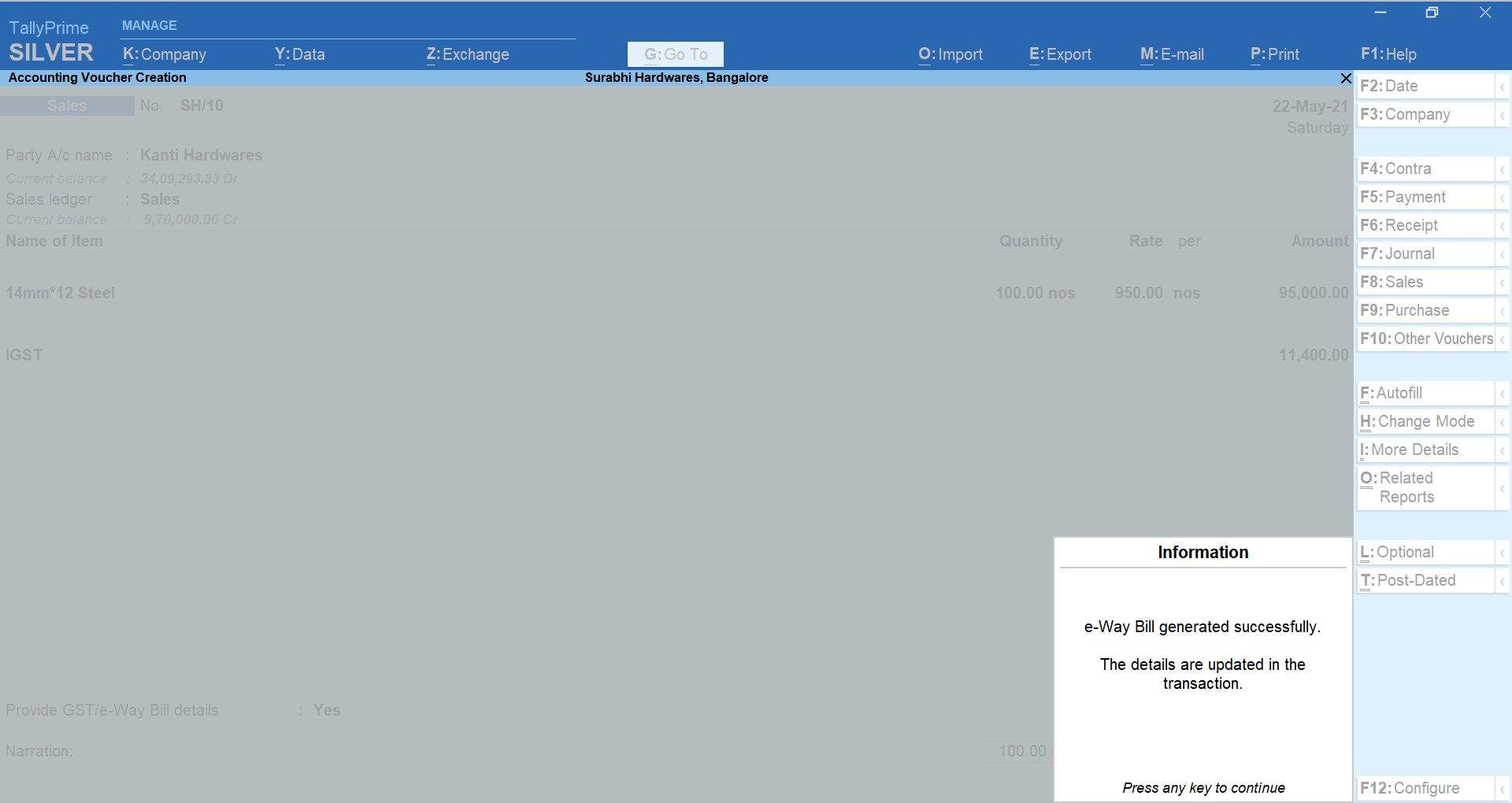

Using TallyPrime’s online connected e-way bill solution, you can instantly generate e-way bills. All you need to do is just record an invoice in your usual way, and TallyPrime will automatically generate an e-way bill and capture the e-way bill number on the invoice.

Tally being one of the recognised ISO certified GSP (GST Suvidha Provider), TallyPrime directly integrates with the e-way portal to seamlessly generate e-way bills for you. It is so simple that you will certainly feel that generating an e-way bill is just the same as invoicing.

Online connected e-way bill features in TallyPrime

Tally’s fully connected e-way bill solution is simple, seamless with zero manual work. Take a look at some of the key features of a connected e-way bill solution.

Generate e-way bill instantly.

Given the compliance need of e-way bills in the process of invoicing and shipment, you no longer need to look at invoicing and e-way bill generation separately. Using TallyPrime, you seamlessly generate an e-way bill online by just recording the invoice. TallyPrime’s full connected solution absorbs the complexity by directly sending the details in prescribed format to the portal and fetches e-way bill details automatically.

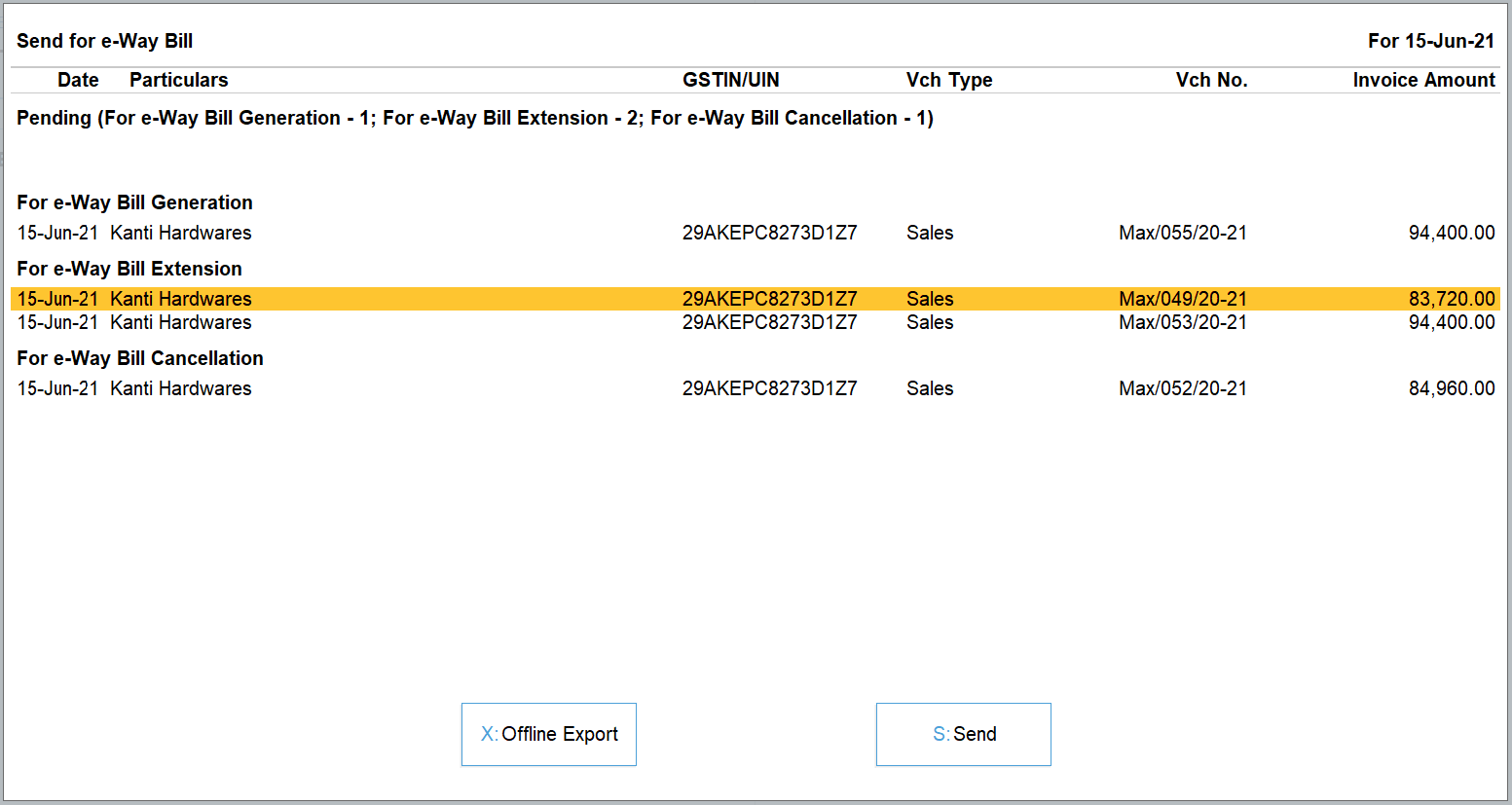

Cancel, Extend and update e-way bill online

In some situations, the invoices for which e-way bill is already generated requires to be cancelled. It could be for various reasons such as data entry mistake/order cancelled etc. Also, in an exceptional circumstance like natural calamity, trans-shipment delay, accident, break-down etc. you may want to extend the validity of the e-way bill. No matter what situations you encounter, using TallyPrime, you can cancel, extend ad update e-way bills online without the need to manually perform these actions from the portal.

Also, for some reason, if you have generated an e-way bill either manually or using any of the available modes (outside TallyPrime), you can auto-fetch such details and capture the e-way bill number on the invoice. Thus, keeping your books up to date.

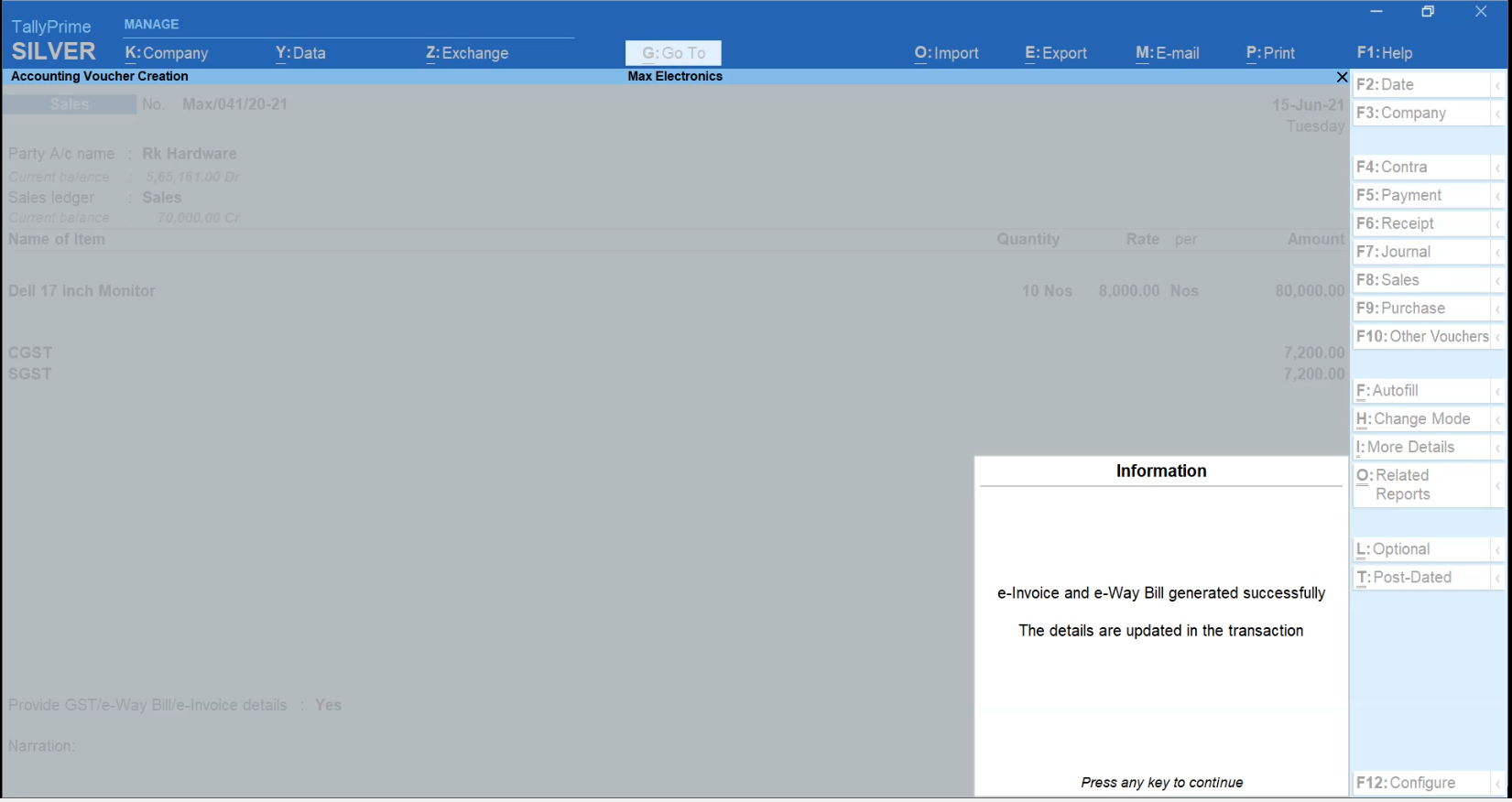

Flexibility to generate EWB online along with e-Invoice or separately.

By design, the e-invoice system (IRP) integrates with GSTN and e-way bill system. As a result, one can generate an e-invoice along with e-way bill as well. Using TallyPrime’s connected e-way bill solution, you get even more flexibility to do so. You can choose to generate an e-way bill along with an e-invoice or can separately generate only e-way bill as it suits your need.

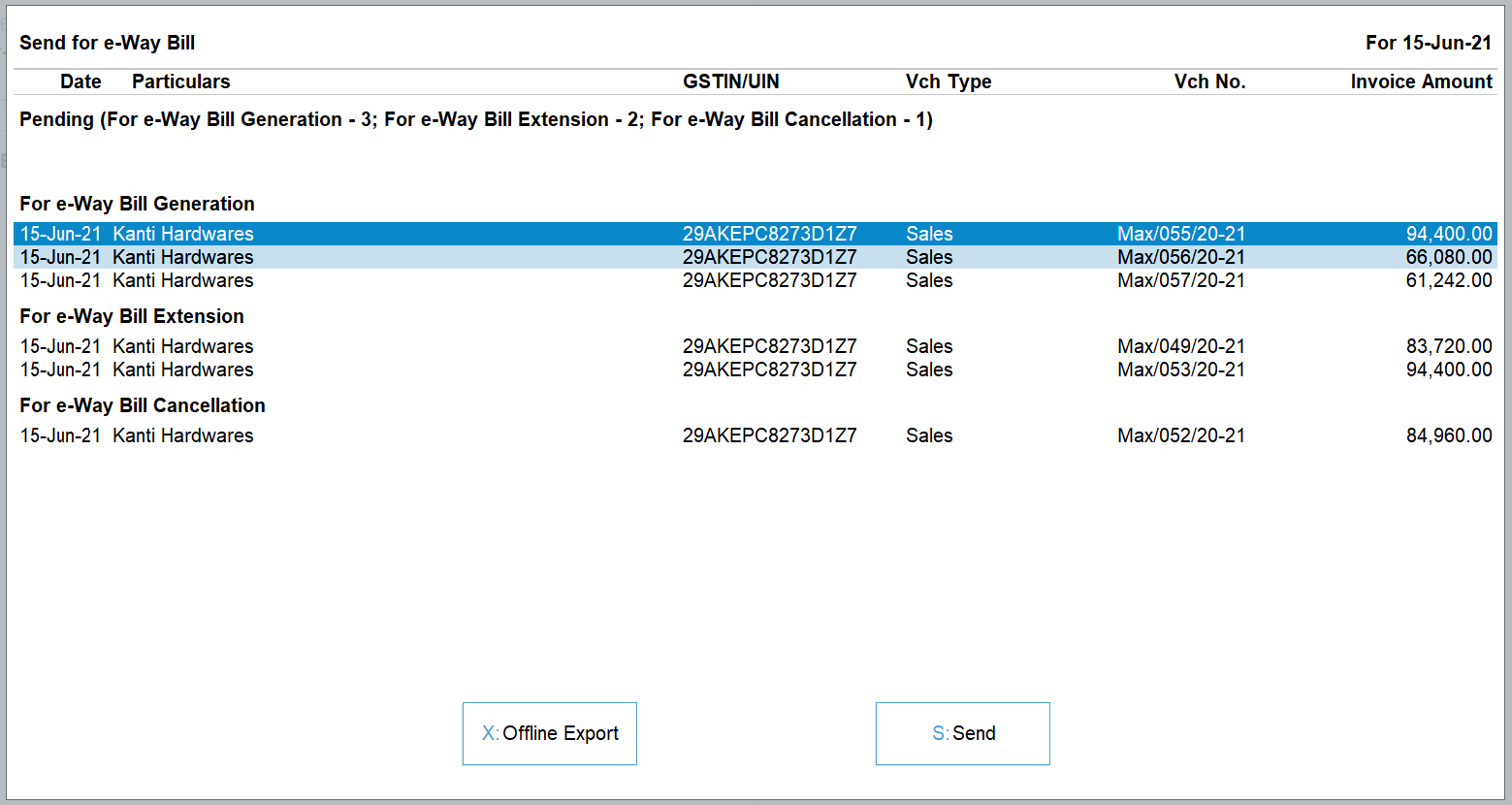

Flexibility to generate e-way bill for a single invoice or in bulk from a report

TallyPrime’s connected e-way bill solution comes with the flexibility to generate e-way bill for a single invoice or in bulk. You can generate an e-way bill for a single invoice in the flow of recording the transaction or you can choose to generate e-way bills in bulk (for more than one invoice) from the report. Generating e-way bills, be it a single invoice or bulk is amazingly simpler and faster.

Enhanced e-way bill reports

TallyPrime’s connected e-way bill solution comes with exclusive reports for e-way bill giving you a complete view of the e-way bill transactions and their status. With the help of the report, you will stay on top of the e-way bill status (Pending/cancelled/generated) and perform various other actions such as cancel, extend, etc. as per your needs.

Supports other modes for e-way bill generation.

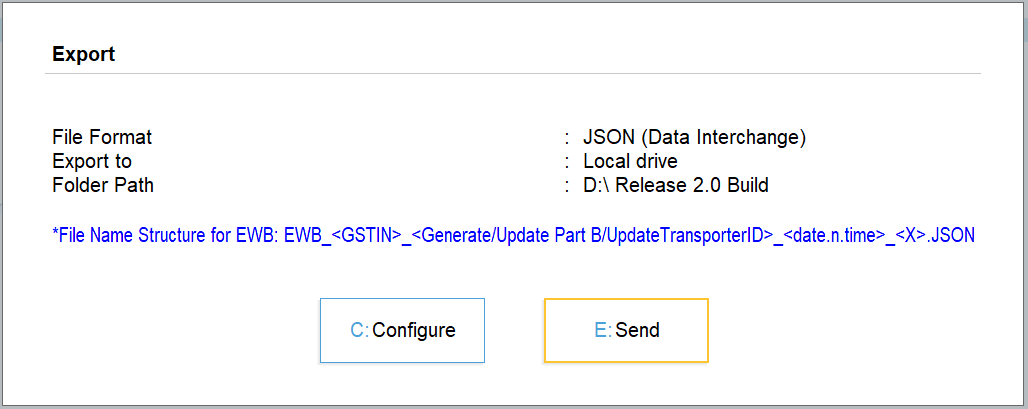

In case of exigency cases like unavailability of internet services on a system or due to any other reason, if you wish to use other modes of e-way bill generation such as using offline utility, a direct entry on the portal etc. TallyPrime fully supports these situations. Â Not only it supports these circumstances, but also auto-fetches details and updates the e-way bill number on the invoice. Thus, keeping your books up to date.

What’s more? The online connected e-way bill solution of TallyPrime comes with an inbuilt alert system to prevent redundancy and ensure that the latest data is shared with the portal, especially in a multi-user environment. Furthermore, the renowned and trusted ‘Prevention, Detection and correction’ capability ensure that the transactions are validated and only the correct and complete details are sent for e-way generation. This way you can prevent errors and work error-free.