GST Council introduced e-Invoicing from 1st January, 2020 on a voluntary basis, for reporting of business to business (B2B) invoices. The GST Council had approved the standard to be used for the e-Invoice in its 37th meeting that was held on the 20th of September, 2019 in Goa. Below are some FAQs on the e-Invoicing system under GST.

What is e-invoicing?

Electronic invoicing or E-invoicing is the new system through which business to business (B2B) transactions are authenticated electronically by GSTN for further use on the common GSTN portal. In simpler words, it is an invoice generated using a standardised format, where the electronic data of the invoice can be shared with others, thus ensuring interoperability of data.

Issue of e-invoices by the taxpayers registered under GST having a turnover above Rs 500 crores has been notified on 13th Dec 2019.

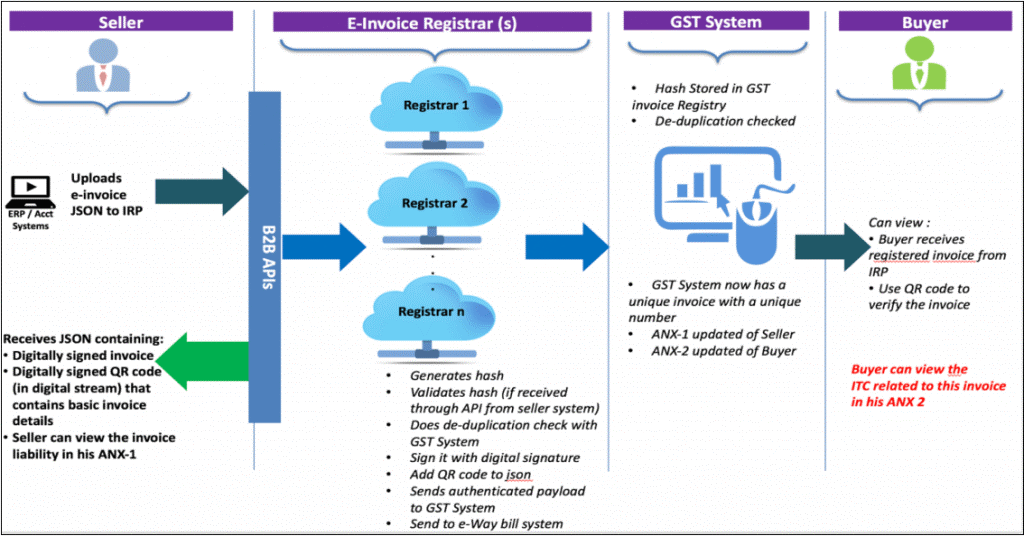

How does e-invoicing model work?

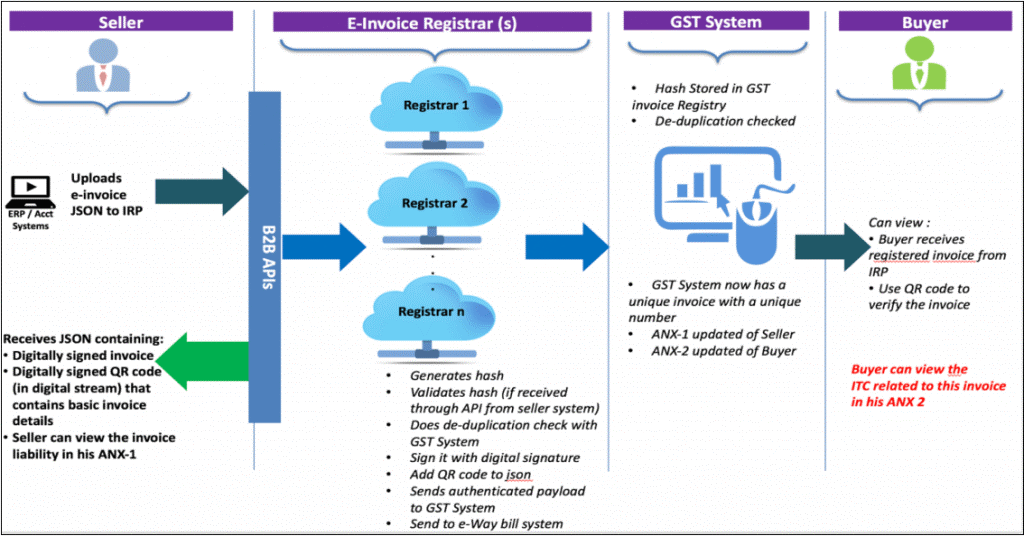

Today, a transaction between the supplier and recipient is done directly without the government having any proof of the exchange. Under the e-Invoicing model, businesses will continue to generate invoices on their respective ERPs just the way it was being done in the past. The only difference is that, the standard, schema and format for the generation of invoices will be specified, to ensure a level of standardisation and the machine-readability of these invoices.

With e-invoicing, the moment an invoice is made, it will be uploaded to GSTN portal where pre-validation will be done, and a unique number called IRN (Invoice Reference Number) will be issued which will then be digitally signed. Once IRN is issued, it will then generate a QR code, containing vital parameters of the e-Invoice. This will be returned to the same to the taxpayer who generated the document in the first place. The IRP will also send the signed e-Invoice to the recipient of the document, on the email ID provided in the e-Invoice.

What are the types of documents that are to be reported into the IRP?

The following documents will be covered under e-Invoicing for now:

- Invoices by the Supplier

- Credit Notes by the Supplier

- Debit Notes by the Recipient

- Any other document as required by law to be reported by the creator of the document

What is the workflow of e-invoice?

Step 1 – Generation of e-invoice:

The taxpayer will continue to generate invoices in the normal course of business. However, the reporting of these invoices electronically has criteria. It needs to be done as per the e-invoice schema along with mandatory parameters. The mandatory fields of an invoice for the supply of goods are listed below:

- Invoice type

- Code for invoice type

- Invoice Number

- Invoice Date

- Supplier details like Name, GSTIN of Supplier, Supplier address (including place, pin code, state)

- Details of the buyer such as name, GSTIN, state code, address, place, pin code, payee name, account number, payment mode and IFSC code

- Dispatch details

- Invoice item being dispatched

- Total tax amount, paid amount and payment due

- Tax scheme (whether GST, Excise Custom, VAT)

- ‘Shipping To’ details like Name, GSTIN, address, pin code, state, supply type, transaction mode (whether regular, ‘bill to’ or ‘ship to’)

- Details of goods like Sl. no., quantity, rate, assessable value, GST rate, amount of CGST/SGST/IGST, total invoice value, batch number/name

The seller has to ensure that his accounting/billing software is capable of generating a JSON of the final invoice. The seller can create a JSON following the e-invoice schema and mandatory parameters by using the following modes:

- Accounting and billing system that offers this service

- Utility to interact with either accounting/billing system, ERP, excel/word document or a mobile app

- Offline Tool to generate e-invoice by keying-in invoice data

Step 2 – Generation of unique IRN:

The supplier has the option to generate ‘hash’ based on specific parameters usually three of them such as Supplier’s GSTIN, Supplier’s invoice number, Financial Year (YYYY-YY). The prescribed algorithm, such as SHA256 must be used for the hash generation. If the hash is validated, it would later become the Invoice Reference Number (IRN) of the e-invoice.

Step 3 – Uploading the JSON:

The following modes may be used to upload the JSON of the final invoice:

- Directly on the IRP

- Through GST Suvidha Provider (GSP)

- Third-party provided apps (including through API)

- The supplier can also upload the hash along with the JSON onto the IRP, if generated by him

Step 4 – Hash generation/validation:

Hash will have to be generated by the IRP in respect of the invoices uploaded without the hash. In such a case, the hash generated by the IRP would become the IRN. Where the supplier has also uploaded hash, a de-duplication check will be performed. It is done by validating the hash/IRN against the Central Registry of GST System to ensure that the IRN is unique. Once validated, the hash/IRN is stored in the Central Registry. IRP will then generate a QR Code and digitally sign the invoice and make it available to the supplier. The IRP also sends the e-invoice via e-mail mentioned on the invoice to the buyer and seller.

Source: last FAQ doc released by GSTN

How will the system of e-invoicing be integrated with GST Returns?

An e-Invoice will be uploaded into the relevant GST return only once it has been validated and registered by the invoice registration system. After the validation has been done, it will be visible to the recipient for viewing and taking action (in the new return system).

The main aim of the tax department is to enable the pre-population of GST returns, which will reduce reconciliation-related problems. Once e-Invoicing has been implemented, the data in the invoices can be pre-populated into the relevant tables of the tax returns without the need for fresh data entry.

What data will be included in an e-invoice?

As per the draft format generated by the GSTN, an e-Invoice will contain the following parts-

- E-invoice schema: This part will consist of the technical field name and the description of each field. It will also specify if a field is mandatory or not, and has a few sample values along with explanatory notes

- Masters: Masters will specify the set of inputs for certain fields, that are pre-defined by GSTN itself. It includes fields like UQC, State Code, invoice type, supply type, etc

- e-Invoice template: The template is as per the GST rules and enables the reader to correlate the terms used in other sheets. The mandatory fields are marked in green and optional fields are marked in yellow

What are the benefits of e-invoicing?

- One-time reporting of B2B invoices while generation, which reduces reporting in multiple formats

- Sales and Purchase Registers can be generated from this data, and GST returns can be kept ready for filing under the new return system

- E-way bills can also be generated using e-Invoice data

- There is minimal need for data reconciliation between the books and GST returns filed

- Real-time tracking of invoices prepared by a supplier can be enabled, along with the faster availability of input tax credit. It will also reduce input tax credit verification issues

- Automation of the tax-filing process

- Reduction in the number of frauds as the tax authorities will also have access to data in real-time

- Elimination of fake GST invoices getting generated