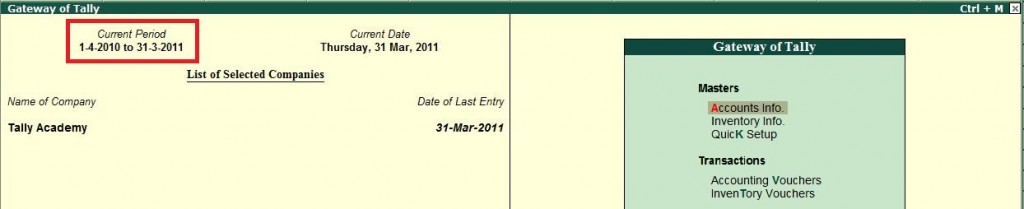

The Current Financial Year is 1-4-2010 to 31-03-2011, and in the Gateway of Tally it displays the Current Period as shown:

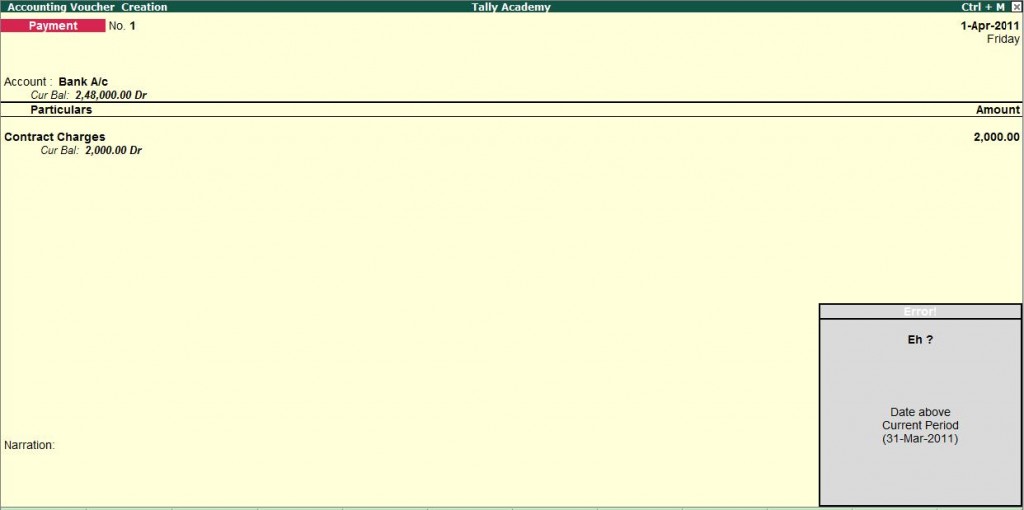

Now if you want to create a voucher on 1-4-2011, the error message Date above current period (31-Mar-11) is displayed.

Now if you want to create a voucher on 1-4-2011, the error message Date above current period (31- Mar-11) is displayed.

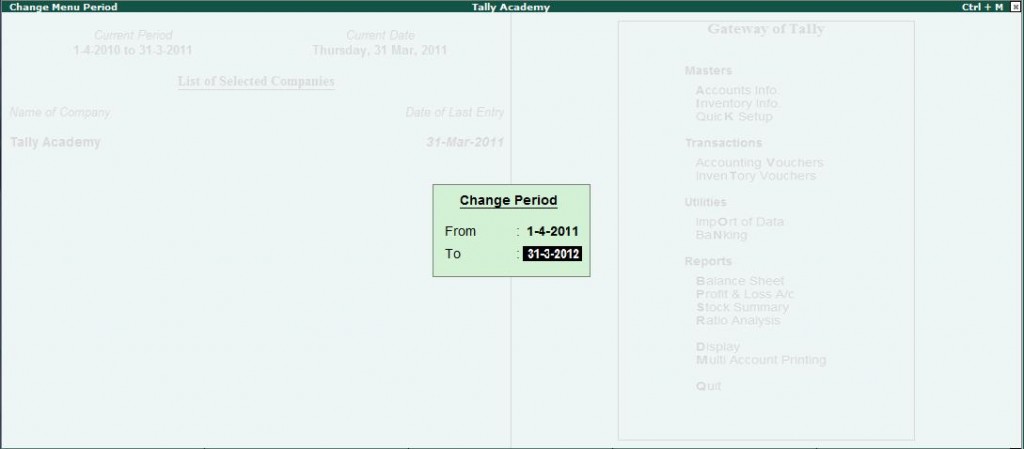

Change the Current Period in the Gateway of Tally by pressing Alt + F2 Change Period 01-04-2011 to31-03-2012, and then record the vouchers for the new financial year.

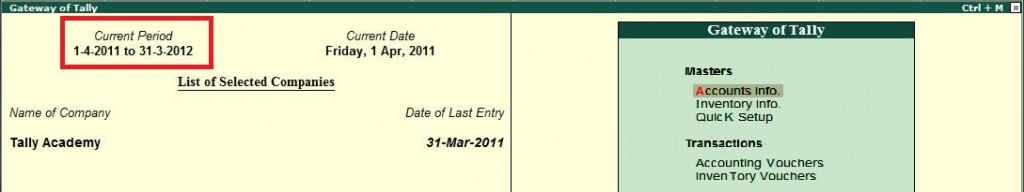

It will change the Current Period information and you will be able to save vouchers for the financial year

2011-12.

Balances of the previous financial period will be carried forward without passing any closing transactions.