Definition of fund flow statement

A fund flow statement is a statement prepared to analyse the reasons for changes in the financial position of a company between two balance sheets. It portrays the inflow and outflow of funds i.e. sources of funds and applications of funds for a particular period.

It is also righteous to say that a fund flow statement is prepared to explain the changes in the working capital position of a company.

Objectives of fund flow statement

A question arises as to why prepare fund flow Statement when we already prepare profit and loss and balance sheet. The need here arises because the profit and loss and balance sheet will not explain the reasons for a change in the financial position.

Profit and loss a/c and balance sheet will give two years figures i.e., current years and previous years. But it will not explain as to why the movement has happened, let’s say, the extent of use of long-term funds for a long-term needs and the use of short-term funds for a long term and short term. Here is why fund flow statement is prepared.

Broadly, a fund flow statement will give us the following two information:

- Sources of funds – From where the funds have come in

- Application of funds – Where these funds have been used

Components of a fund flow statement

A fund flow statement comprises of :

- Sources of funds: It talks about the extent of funds availed from

- Application of funds: It talks about how the funds have been utilized

- Funds deployed in Fixed assets

- Funds deployed in Current assets

Fund flow statement explained with examples

National Enterprises raised its funds from the following equation listed below:

- Long term funds for its noncurrent assets.

Explanation: Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property, plant and equipment.

So, going by the accounting parlance, long term funds are generally raised by a company to meet its long-term requirements. So National Enterprises using its long-term funds for its non-current assets are the right utilization of funds and these details are explained by fund flow statement.

- What if National Enterprises uses its short-term funds to finance its long-term assets?

Here the fund flow statement when prepared conveys the users of financial information that the usage of the fund has not been made properly by the company as it is living dangerously by utilizing its short-term funds for financing long term assets.

It means that when the company is in need for funds for repaying it to the short-term obligation, it will be in cash crunch situation since once an investment is made into long term assets by the company it, it will not be in a position to convert it into liquid cash at a later stage due to the nature of the investment.

This is how the fund flow statement explains the source of funds and its utilization or application, allowing the users of financial information interpret and know the impact on the business.

Benefits of preparing a fund flow Statement

- It helps to explain the managers of funds as to why the company is sitting in liquidity strain despite making profits as reflected in profit and loss statement.

- On the contrary, it helps the managers to understand as to how a company is financially strong despite losses made by it in its operation front.

- A fund flow statement helps us to analyze whether any short-term funds are being used for long term purposes. The grey area which can only be highlighted by preparation of fund flow Statement.

Users of funds flow Statement

The most interested users of fund flow statements are the lenders of capital. They pay more attention to the fund Flow Statements than the Profit and Loss and Balance sheet.

For Example, Bankers who lend money to the company as Overdraft or Cash Credit in return for interest. The bankers use the information provided by the company in its profit and loss statement and balance sheet in preparing fund flow statements, which then enables them to take decisions as whether to provide its overdraft or cash credit facilities to its clients or not.

| Sources of Funds |

|

Application of Funds |

|

| Â Capital

Debts

Funds generated from operations

Sale of assets (if any)

·      (Bal.fig) Excess usage of funds over sources.

[Decrease in working capital] |

xxx

xxx

xxx

|

Funds utilised in creation of Fixed assets

Funds utilised in creation of other Non- current assets.

Funds utilised in repaying existing loans.

Funds utilised for paying dividends, taxes

*(Bal.fig) Excess of Funds over application of funds –

[ Increase in working capital]

|

xxx

xxx

xxx

xxx

xxx |

| Total |

xxx |

|

xxx |

- Increase in working capital

Possibilities may arise when long term sources are in abundance of uses or application resulting in a gap. Which we call in fund flow statement as ‘Increase in working capital’. As it is a free flexible source which can now be used by the company for funding its working capital requirements. Say short term loans outstanding (if any) can be paid from the long-term sources slot or dividends be paid etc.,

- Decrease in working capital

Possibilities that the company has more uses of funds, but it has very limited long-term source available. At that time, the company will go for funds which are available in the nature of working capital.

As a result, the company will reduce the funds available for working capital and divert it for long term uses. So, by decreasing the working capital, we get the funds which are available for long term uses which form part of the source of funds.

The increase or decrease in working capital can be known by preparing a statement of changes in working capital. This statement compares the values of two years of the difference between Current asset and Current Liabilities and tells as to whether there is an increase or decrease in working capital.

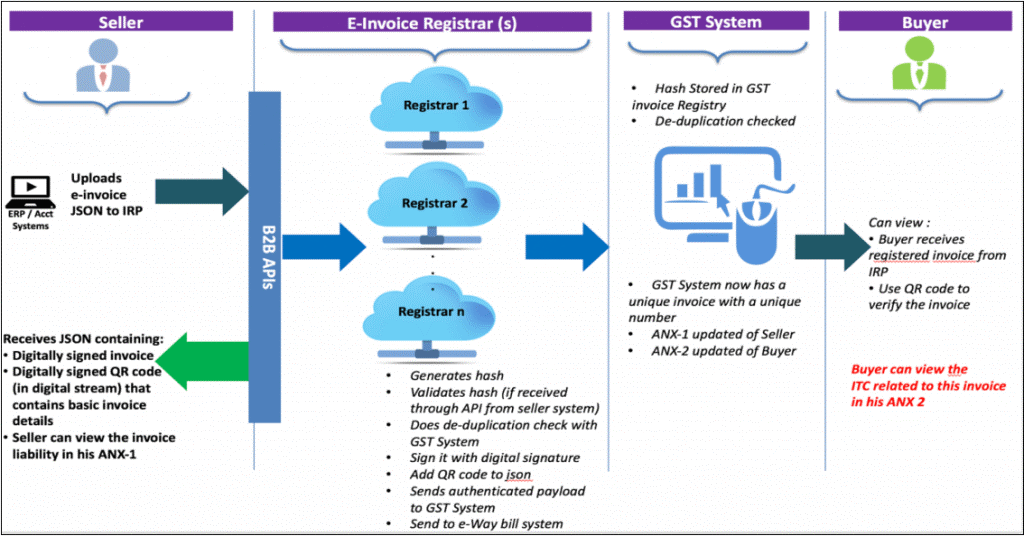

How do modern businesses prepare a fund flow statement?

Given the importance of fund flow statements brings to the table, most of the businesses prepare and analyze this statement more frequently. Today, most businesses use ERP software or accounting software which automatically prepares the fund flow statement along with various other financial statements. This allows business owners and other users of financial information to analyze and make on-time smart business decisions.