As you must be aware, the Goods and Service Tax is largely payable on a self-assessment basis. If the assessee pays the right amount of tax, there is no problem. However, if there is any short payment or wrong utilisation of input credit, then the GST authorities will initiate demand and recovery of tax under GST provisions, against that particular assessee. Under the GST Act, provisions relating to demand and recovery are quite similar to the provisions under the erstwhile Service Tax and Central Excise Act norms. In this blog, we will understand the provisions of demand under GST in detail.

When can a demand under GST be raised?

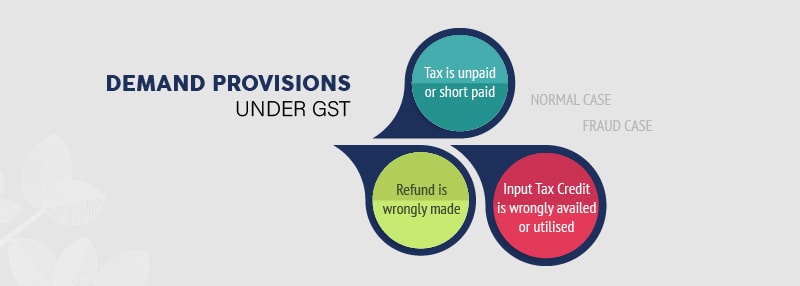

The GST Act contains elaborate demand provisions under GST as well as provisions for recovery of tax under various situations, which can be broadly classified as follows:

- Tax is unpaid or short paid

- Refund is wrongly made

- Input Tax Credit is wrongly availed or utilised

Now, these situations can happen, either because of an inadvertent bona fide mistake (normal case) or because of a deliberate attempt to evade tax (fraud case). Since the nature of offences is totally different in both the cases, separate recovery and demand provisions under GST have been laid down for each type of case. These provisions attempt to encourage voluntary compliance, under certain specific timelines, which are discussed below.

Demand of tax when there is no fraud

As per the rules of demand in GST, when there is no fraud, no wilful misstatement or no suppression of facts – in other words, no motive to evade tax, the demand of tax provisions are comparatively more lenient.

Time Limit to issue Show Cause Notice & Order

As per the provisions of demand under GST, the proper officer i.e. the concerned GST authority is required to primarily issue 2 notifications, which serve as opportunities to the defaulter – Show Cause Notice (SCN) & Order.

- Order – 3 years from the due date of filing Annual Return for Financial Year, to which the amount relates

- Show Cause Notice (SCN) – 3 months before the date of issue of the Order, i.e. 2 years and 9 months from the due date of filing Annual Return for the Financial Year, to which the amount relates.

Once the above notice has been issued, the proper officer can then serve a statement, with details of any unpaid tax / wrong refund etc., for other periods which are not covered in the notice. This means, that a separate notice does not have to be issued for each tax period, which the concerned authority wants to highlight, as per the provisions of demand under GST.

Penalty Scenarios

- Before SCN – If the taxpayer pays the tax along with interest, based on his own calculations, or the officer’s calculations, and informs the same to the officer in writing, before the SCN is issued, then the officer will not issue any notice, nor charge any penalty. However, if the officer finds that there is a short payment, they can issue a notice for the balance amount.

- Within 30 days of SCN – If the taxpayer pays all his dues within 30 days from the date of issue of the SCN, then the penalty will not be applicable, and all proceedings and prosecution regarding the notice will be closed.

- Within 30 days of Order – If the taxpayer pays all his dues within 30 days from the date of issue of the Order, then penalty will be charged at 10% of tax subject to a minimum of INR 10,000.

- After 30 days of Order – If the taxpayer pays all his dues after 30 days from the date of issue of the Order, then penalty will be charged at 10% of tax subject to a minimum of INR 10,000.

To sum up,

| Due Payment Date | Penalty |

| Before SCN | No penalty |

| Within 30 days of SCN | No penalty |

| Within 30 days of Order | 10% subject to a minimum of INR 10,000 |

| After 30 days of Order | 10% subject to a minimum of INR 10,000 |

Demand of tax when there is fraud

As per the demand rules in GST, such provisions arise, when there is unpaid or short paid tax, wrong refund or wrong utilisation of ITC, under the following situations:

- Fraud

- Wilful misstatement

- Suppression of facts

Time Limit to issue Show Cause Notice & Order

As per the provisions of demand under GST, even in the case of fraud, the proper officer i.e. the concerned GST authority is required to primarily issue 2 notifications, which serve as opportunities to the defaulter – Show Cause Notice (SCN) & Order. However, the timelines are different as follows:

- Order – 5 years from the due date of filing Annual Return for Financial Year, to which the amount relates

- Show Cause Notice (SCN) – 6 months before the date of issue of the Order, i.e. 4 years and 6 months from the due date of filing Annual Return for the Financial Year, to which the amount relates.

Once the above notice has been issued, the proper officer can then serve a statement, with details of any unpaid tax / wrong refund etc., for other periods which are not covered in the notice. Similar to the previous scenario, a separate notice does not have to be issued for each tax period, which the concerned authority wants to highlight, as per the provisions of demand under GST.

Penalty Scenarios

- Before SCN – If the taxpayer pays the tax along with interest, based on his own calculations, or the officer’s calculations, and informs the same to the officer in writing, before the SCN is issued, then the officer will not issue any notice, but a penalty of 15% will be charged. However, if the officer finds that there is a short payment, they can issue a notice for the balance amount.

- Within 30 days of SCN – If the taxpayer pays all his dues within 30 days from the date of issue of the SCN, then a penalty of 25% will be applicable, and all proceedings regarding the notice will be closed.

- Within 30 days of Order – If the taxpayer pays all his dues within 30 days from the date of issue of the Order, then a penalty of 50% will be applicable, and all proceedings regarding the notice will be closed.

- After 30 days of Order – If the taxpayer pays all his dues after 30 days from the date of issue of the Order, then penalty will be charged at 100% of the tax amount.

To sum up,

| Due Payment Date | Penalty |

| Before SCN | 15% |

| Within 30 days of SCN | 25% |

| Within 30 days of Order | 50% |

| After 30 days of Order | 100% |

Note: However, as per the latest demand rules in GST, with respect to self-assessed tax and / or any amount collected as tax, a penalty of 10% will still be payable where payment has not happened within 30 days from the due date of payment of the tax. In these cases, penalty will be applicable irrespective of whether or not the taxpayer pays before or after SCN i.e. the due date of payment will be considered more important than date of issue of SCN, over-riding all the rules stated above.

The GST Act also ensures timely disposal of cases by further providing that if the Order is not issued within the stipulated time limit of 3 years or 5 years, as the case may be, the adjudication proceedings shall be deemed to be concluded. This has ensured a strong mechanism for recovery and demand in GST, which will hopefully go a long way to wipe out tax evasion across the nation.