The payroll process is an essential activity in an organization with employees. Depending on the structure of the salaries and the prevailing laws and regulations, the calculation of payroll can be either simple or more complex. It is vital to process payroll in a timely and accurate manner. Any discrepancies in the calculations have a direct impact on employee morale and productivity.

The payroll process also involves compliance with the regional laws and regulations. If there are mistakes that are not in compliance with the rules, it could put the organization into legal and financial trouble. An accurate and effective payroll process is essential in any organization whether big or small. Using business management software with capabilities to manage payroll makes the entire process simpler and error-free.

The payroll is the amount of money that the employer pays out to employees for their services. Every organization has a list of add ons and deductions from the basic pay of the employee. These involve allowances, bonuses, taxes etc.What is payroll process?

To have a payroll process, every organization must:

- Define a pay policy with basic pay, benefits, leave policies, encashment of leave and other related items

- Define the components that appear on the payslip as per the company’s policy and in compliance with regulations

- Obtain and record the employee details accurately. This includes the bank account details, tax details etc.

- Validate the employee inputs

- Calculate the statutory as well as non-statutory deductions and deduct them to arrive at the gross pay amount

- Pay the salary amount to the employees through the mode that the company employs. Most often this is done by intimating the bank of the salary amount to be disbursed to each employee account

- Record the payroll transactions in the accounting system

- Pay the dues to the appropriate authorities and file returns accurately and before the due dates

- Physically or digitally (PDF) distribute payslips and other relevant tax documents to the employees.

How to process payroll in easy steps?

The payroll process steps are categorized into the following

- Pre-payroll process,

- Payroll calculation process

- Post-payroll process

Let’s discuss each of these in detail.

Pre-Payroll Process

Defining the payroll policy

Different organizations have their own unique payroll policies. These should be very clearly and unambiguously defined. The first step is to define the basic pay for the different designations in the organization. Leaves and benefits are monetized differently in each organization. There may be deductions for leave taken beyond the given quota. Unused leave may be convertible to money. Some organizations pay for overtime while others do not. Certain companies have the practice of an annual bonus payout. If the bonus is performance-based, the policy should be well defined. The accurate computation of this amount is essential. The payroll policy should be approved by the management of the organization.

Data gathering

The details of an employee are usually collected and recorded at the time of onboarding a new employee. This may include their PAN number, other ID numbers and details.

Attendance and performance data

Payroll also requires the attendance data of the employee. If any bonuses or benefits are due, the relevant department would have to provide the data to payroll. If the employee has earned a performance bonus or a raise, it should be recorded by payroll. In a smaller organization, this data would be easy to gather and compute. In a larger organization, this flow of data to payroll is more challenging. Business management software with an integrated payroll system makes the data flow easier and more accurate.

Validation

All the data received would have to be validated for accuracy and compliance with the organization’s policies as well as the law. Payroll would have to ensure that no employee who has left employment continues to feature as an active employee for payroll calculation. All the current employees should be included for salary calculation without missing anyone.

Payroll calculation process

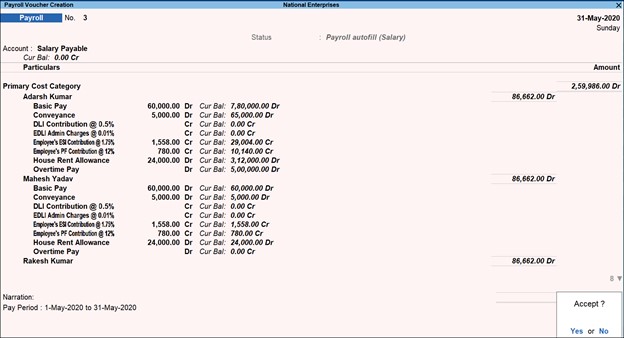

This is the payroll process that takes place based on the data input.Payroll is calculated manually or through the use of software to calculate the net pay after factoring in gross income and gross deductions.

Gross income/salary = regular income + allowances if any + one time payment or bonus if any

Gross deduction = regular deductions + statutory deductions + one-time deductions if any

Net pay = Gross income – gross deduction

If the payroll is calculated manually, these values are checked for accuracy and errors if any are corrected.

Post-payroll process

Payroll accounting

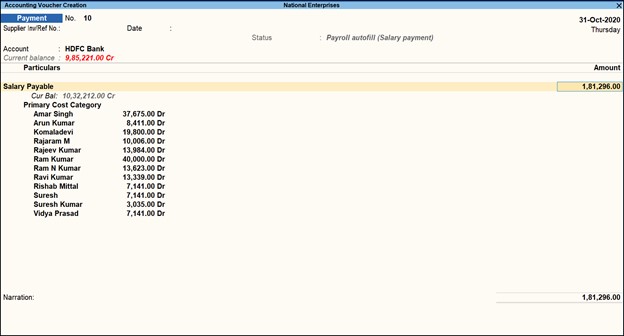

The amount of salary disbursed as well as the different components of additions and deductions have to be accounted for. The relevant transactions have to be recorded and entered as per the accounting practices of the organization. If the company uses a standalone payroll software or HR software the data would have to be reentered into the accounting software.

Salary payout

The actual payment of salary to the employees is most often through bank accounts. The organization’s bank account should be sufficiently funded before initiating the salary disbursal payroll process. A salary bank advice statement is generated based on the net pay for each employee along with their account number.

Reporting

Payslips and tax details are generated and given to the employees physically or digitally. Payroll reports that are required by the management have to be generated and submitted.

Compliance

The statutory deductions that are made from the employees’ salaries have to be paid to the relevant government agencies. The amounts have to be paid and the returns filed well within the due dates.

Process payroll accurately and on time every time

When there are gaps in the payroll data flow, the chance of computational or data entry errors is higher. It is essential that payroll should be error-free and in compliance with the laws and regulations. TallyPrime makes the payroll process quick and easy.

The benefits of payroll accounting with TallyPrime are:

- Integration with financial accounting. Tally seamlessly integrates the payroll amounts to the accounting process. There is no necessity for reentering all the payroll data into the accounting software

- Generates payslips for employees

- Enables payroll processing with compliance

- Also tracks the loan details of employees

- Allows flexibility in user-defined classifications, departments, groups, subgroups and other criteria. It also allows the user to define all the components of payroll such as attendance/time/production units, earning and deduction pay heads.