How to use lower deduction TDS rates for certain suppliers

By virtue of Section 197/197A an assesses can get a certificate of lower deduction from the ITO.

Such certificate will include your TAN number, Assesses PAN Number, Period of applicability, approx. billing amount to you during the period and the % of TDS by which you should deduct TDS on the same.

Let’s assume one of your supplier presents you such a certificate of lower deduction of tds at a rate of 6%, then you must deduct the same as per the certificate produced to you.

Let’s learn how to manage the same in Tally.ERP 9. Once you make the settings as per below then whenever you book the invoice of such supplier then TDS will be calculated and deducted from the bill automatically at the rates specified as per the lower Deduction certificate

- Go to related supplier’s ledger who produced you the lower deduction certification

- (Note : Enable “Allow ADVANCED entries in TDS Master†form F12 configuration)

- Enable “ Is TDS Deductable�

- Deductee Type : select deductee type from the list

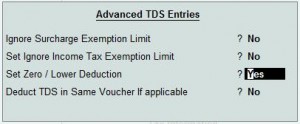

- Use Advanced TDS Entries : Set to “Yesâ€

- You will find a pop up as per below

- Enable “ Set Zero/Lower Deductionâ€Â to “Yesâ€

- You will find below screen

- Select the Nature of payment applicable from the pop up window list

- Set section number (it will be shown in the lower deduction certificate

- Mention necessary details and save it.

If you are not aware of TDS features in tally then you should referTDS help file for further reference